UK HE online student trends 2023/24: Analysis of the latest HESA data

This year has seen a more timely release of what is still backdated information on students in UK higher education. Early April saw the release of 2023–24 student data from the Higher Education Statistics Agency (HESA), which, among other things, is a key data source for understanding online student and enrolment trends in UK HE.

The earlier release is welcome, although it still comes much later than January, when this data used to be published. Also welcome is the fact that we now have two years’ worth of data on online students using the new reporting model, which enables greater confidence in year-on-year comparisons.

This brings us into an interesting area around the quality and reliability of the data. It would be unwise to assume this provides a 100% watertight and accurate picture of online student numbers in UK higher education. However, it is the best data we have and should be viewed as indicative of where we are and where things might be heading. In recent years, there have been several reporting errors concerning online students, and not everything captured in the overall figures refers to an online student studying an online degree.

Another aspect worth highlighting is that UK-based and international online students are not reported in the same way. As such, this analysis focuses exclusively on UK-based online students, and I’ll cover international trends in a separate post.

Overall online distance learning student numbers in 2023-24

By way of recap, 2022–23’s online distance learning student numbers showed a decline in the overall numbers of UK-based undergraduate degree students (a drop of 7,000) and postgraduate-taught (PGT) students (a drop of 2,000). However, due to changes in reporting, it felt wise to hold back from drawing major conclusions from year-on-year comparisons at that stage.

The 2023–24 release, however, shows a further decline in the number of UK-based online undergraduate degree students (a drop of nearly 5,000), and an increase in the number of UK-based online PGT students of nearly 4,500.

The 2023–24 data recorded the following totals for UK-based online distance learning students:

135,550 – Undergraduate degree students

43,470 – Other undergraduate students*

93,900 – Postgraduate-taught (PGT) students

*These are typically qualifications below the level of a full degree, such as foundation degrees, HNDs, CertHEs, etc.

It is worth digging into some of these numbers separately to get a clearer sense of the trends and the current picture.

Trends in UK online undergraduate degree enrolments (2023/24)

2023–24 saw a 3.4% drop in the number of UK-based online undergraduate degree students, following a 4.8% drop in 2022–23. However, looking at student numbers over the past five years gives a clearer view of enrolment trends and shows that the number of online undergraduate degree students is still higher than in the pre-Covid academic year of 2019/20.

The pandemic had a clear impact on enrolment data, driving a nearly 20% increase in the number of UK-based online undergraduate degree students in 2020/21. The trends shown in the chart indicate a decline in student numbers since the pandemic peak, but overall numbers remain higher than before the pandemic.

In my view, it is difficult to conclude that we are seeing a real step change in demand for online undergraduate degrees, and it remains hard to make a confident case that they are becoming an increasingly popular choice. There is a market here that shows signs of steady growth, but it is one to be navigated carefully. The next two years of student data will be especially helpful in gauging the trendline and providing a clearer reading of this market.

Overall student numbers are one way of understanding trends and demand, but another useful approach is to analyse the performance of specific universities. This is easier to do at this level, as relatively few UK universities are seriously invested in online undergraduate degree provision. Many of those that are, have seen enrolment increases over the last five years ranging from 2,500 to the low hundreds.

Below is a table showing the universities that reported the most UK-based undergraduate degree distance learning students in 2023/24. It’s worth viewing this as a list of the providers that reported the highest numbers of UK-based online undergraduate degree distance learners, rather than a definitive ranking of the top ten online undergraduate degree providers, some names would remain, but others might not appear if the list were based on fully online UG degree students.

Largest UK universities by number of UK-based undergraduate degree distance learning students in 23/24

The provider that looms largest in this market segment is the Open University, with a nearly 80% share of the UK-based online undergraduate degree market. The OU’s overall online student numbers have largely mirrored overall enrolment trends. They saw a significant decline in the number of online undergraduate degree students in the 2022–23 and 2023–24 reported data, following a sharp increase between 2019/20 and 2020/21.

In the OU’s more recent accounts, they make an oblique reference to market share, stating that not meeting student recruitment targets was due to “a decline in our core market share.” This suggests they feel they are losing ground, and there is certainly competition emerging. Arden University is the biggest challenger in this market segment and the fastest growing. Unlike the OU, it has reported consistent year-on-year growth in student numbers since 2015/16.

While there has been an increase in the number of online undergraduate degrees available, overall there remains limited supply across the sector, with relatively few universities offering anything close to a portfolio of online undergraduate degrees. Broadly, this reflects a lack of confidence in the market and the high cost of entry, and this becomes even more stark when juxtaposed with the UK online postgraduate-taught market.

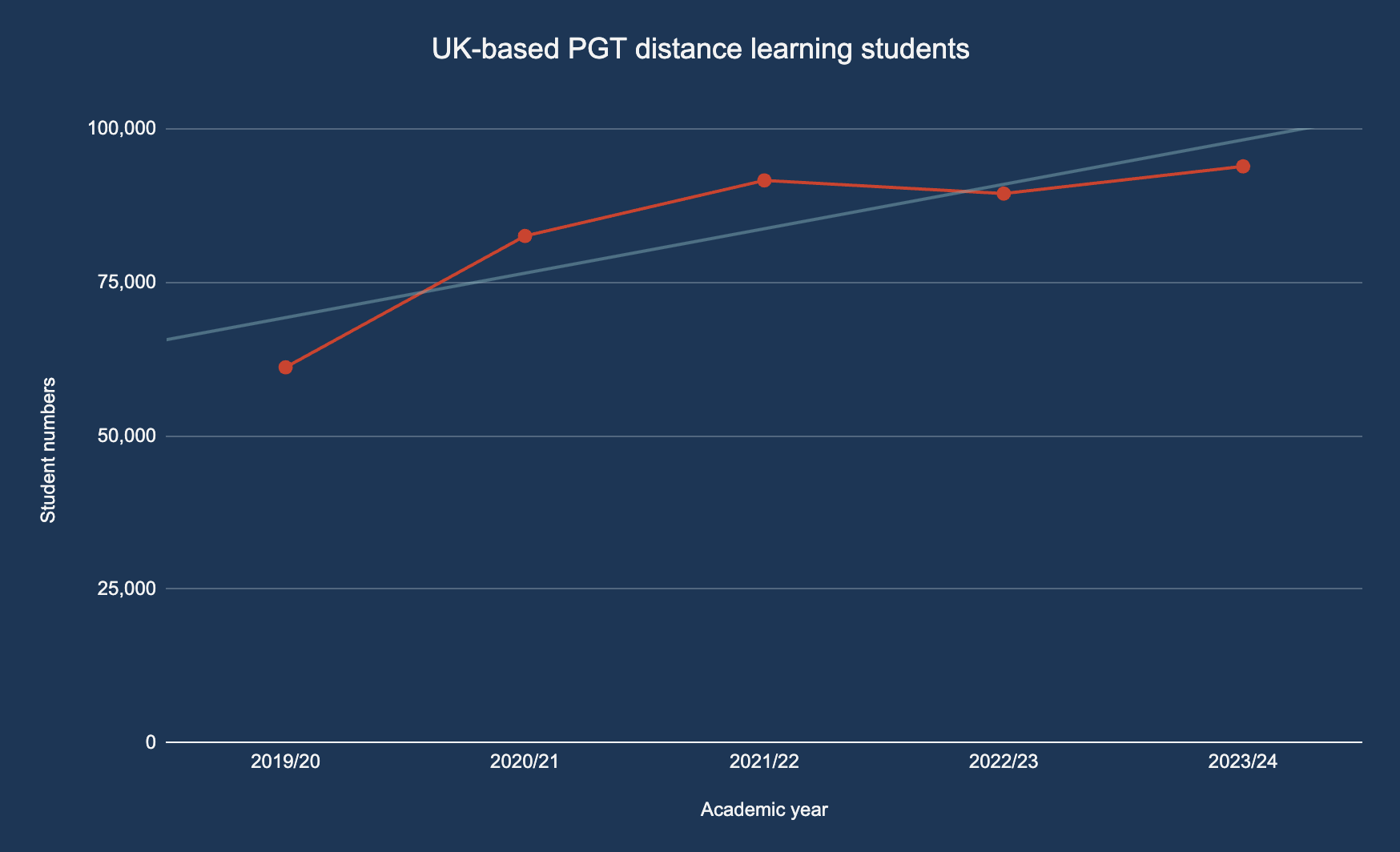

UK online postgraduate-taught (PGT) enrolment trends (2023/24)

Which brings us neatly to the trends for UK-based online postgraduate-taught (PGT) students. The 2023/24 data shows a 5% increase in this market segment, from 89,470 in 2022/23 to 93,900 in 2023/24. Of all the main market segments for online students, whether UK-based or international, this continues to be the strongest, with consistent growth since 2019/20. It’s not only the increase in student numbers that inspires greater confidence in this market, it’s also the fact that it aligns well with the archetypal online student, who is typically older and balancing other significant commitments alongside study.

By my calculations, nearly 28% of all UK-based PGT students are now studying via online distance learning, up from 17% in 2018/19. The flexibility that online courses offer clearly aligns well with this level of study and is an option chosen by an increasing number of UK-based students. A question that future years’ data may help to answer is whether we have reached the ceiling for online study at this level, have we peaked at nearly a third of all students, or could this grow further? Given the increasing supply of online master’s programmes, many universities will be hoping there is still room for growth, enabling them to secure a sustainable share of what is becoming an increasingly competitive market segment.

Looking at specific universities, a number reported significant increases in student numbers in 2023/24. However, I do have some reservations about certain figures. It is unclear whether some of these increases are simply a result of inconsistent reporting over recent years or whether they reflect other types of provision beyond full online PGT degree enrolments. The most notable increases, in which I have greater confidence, were seen at Arden University, University of Hull, University of Wolverhampton, University of Law, University of York, and Anglia Ruskin University.

Below is a table showing the universities that reported the highest numbers of UK-based PGT distance learning students in 2023/24. As with the undergraduate list, similar caveats apply: my own list of the top ten online PGT providers would include some of these universities, but not all.

Largest UK universities by number of UK-based PGT distance learning students in 23/24

Overall, UK universities that could be considered strategically invested in this market segment have experienced mixed fortunes, highlighting both the competitive nature of the market and the varied performance of OPM partners. Unlike the online undergraduate degree market, there is less consistency in terms of growth amongst strategically invested providers.

The most notable student number decline in 2023/24 was a further drop of over 1,000 PGT students at the Open University. Smaller, but still significant declines in online student numbers were also recorded at King’s College London, University of Dundee, Heriot-Watt University, University of Leeds, and Wrexham University.

Comparing online enrolments to sector-wide trends in UK higher education

The focus so far has been on what the 2023/24 data release tells us about online student number trends, but it’s useful to consider this in the context of the broader headlines from the release. The main overarching message was a drop in overall student numbers and new entrants. These were the key points:

A 1% decrease in the number of students enrolled overall

A 3% decrease in new entrants to higher education courses

Undergraduate degree entrants dropped by 1%

Postgraduate taught students dropped by 8%

Unsurprisingly for those familiar with the UK higher education sector, the biggest fall in new entrants has been among international PGT students, with 30,000 fewer entrants in 2023/24 than the previous year. The reasons behind the decline in international students coming to study in the UK are well understood and are likely to remain a challenge, particularly given the UK government’s stance on immigration.

How should we reflect on this in relation to online student trends and enrolments? One notable aspect of the 2023/24 data was the decline in new entrants to full-time study across almost all levels, while part-time study saw some increases, particularly at postgraduate level. This reflects positively on more flexible forms of study, and the overwhelming majority of UK-based online students are part-time learners. While the overall release may make for grim reading, pointing to a contracting UK higher education sector and adding to the financial pressures already facing universities, there is some positive news in the UK-based online student data. It hints at a growing preference for flexible study, especially at PGT level.

What the HESA data reveals about online education in UK HE

What we have here is another year of delayed data, gathered through the new reporting model and still containing a number of errors. While there are signs of progress, these issues are worth keeping in mind.

The data confirms that the trendline for online student numbers continues to rise, though it is more consistent and pronounced at PGT level than for undergraduate degrees. This will come as no great surprise to observers of the UK online student market, given the longstanding alignment between the needs and circumstances of PGT students and the flexibility of online distance learning.

Once again, the data underlines that long-term, well-considered strategic investment in online provision tends to deliver results. The sector may not currently be well positioned for investment in a new line of provision or long-term plays that grow steadily over time, but for many institutions this is exactly what will be required to diversify and gain a foothold in the UK online student market.

Overall, this data highlights a positive trendline for online enrolments and flexible study, but it doesn’t support the hyperbolic headlines that sometimes accompany rises or falls in online numbers. It’s a case of steady progress rather than a surge, one that needs to be interpreted carefully in light of the atypical, pandemic-driven figures of past years.