UK Higher Education VLE Market: 2025 Review

It’s time for my fifth annual review of the virtual learning environment (VLE) market in UK higher education (HE). Since 2020, I’ve been tracking and analysing developments in this market on an ongoing basis, and publishing retrospective annual reviews that focus on shifts in market share, developments within the main company players, and the evolution of their products and platforms.

Before we get into that, it is worth reflecting on the durability of these products and, by extension, the market. Virtual learning environments (VLEs) have now been in existence and in use at universities since the 1990s and early 2000s. They have outlasted many obituaries written for them, and while there have been companies, their products, and in-house university versions that have fallen by the wayside, there are only a tiny number of UK higher education providers without a VLE. All of these are small providers and, to date, there is no serious or widespread exploration of what would constitute a genuinely differentiated alternative.

This is worth emphasising at the outset, as I am particularly struck at the moment by the juxtaposition between the realities and evidence of actual change and the sheer volume of discourse about change and the future. It’s not difficult, on a daily basis, to stumble across the fetishisation of change, and a kind of performative, addictive enthusiasm for transformation that is often unsubstantive and ill-informed.

Virtual learning environments emerged during a period of genuine substantive change, with the establishment of the web and a particularly dominant interface and interaction paradigm. That paradigm has evolved and become far more sophisticated, and will no doubt continue to do so, but whether it will be replaced to anything like the same extent, such that we can claim the old has gone and something genuinely different has replaced it, is a question for time to answer.

Anyway, I digress. At the outset of last year’s review, I noted how it had felt like a quieter period with somewhat less to report, but the same cannot be said for the last twelve months. This has never been the most dynamic market or landscape, but over the last year there have been a number of developments that could not have been more closely aligned with longer-term trends and patterns if they had been deliberately engineered to do so.

Whether in the fortunes of companies, the profile of HE providers adopting particular VLEs, or the companies chosen for portfolio and product expansion, the most significant developments of the year align closely with patterns seen in recent years. Let’s get into it.

VLE market share trends and movements

Although, in the early days, the virtual learning environment (VLE) market had a far more diverse range of companies and products, for many years now the market has been consolidated around the following four companies and products:

Blackboard from Anthology

Brightspace from D2L

Canvas from Instructure

Moodle

There are a small number of instances of UK HE providers diverging from these, but almost all are among small and or niche providers.

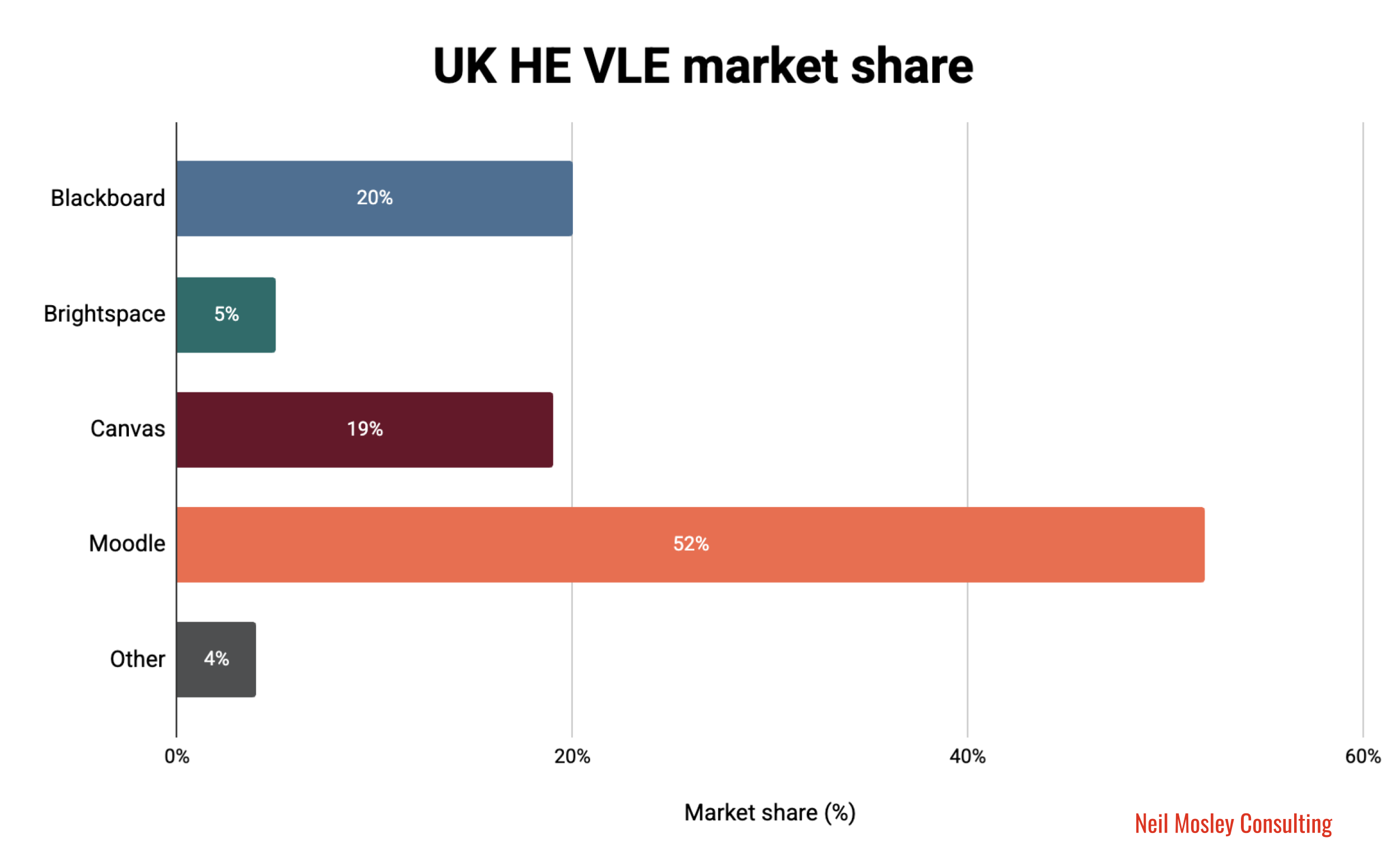

This year there has been a similar level of coverage, with 272 UK HE providers included in the overall analysis. This is an increase on the 264 covered last year, and while this inconsistency might present frustrations for anyone looking for pure time series analysis, the reality is that strict time series market share analysis is difficult at this level.

One of the reasons for this is that the 272 include a number of new and emerging providers that were not included last year, while also omitting providers that have since disappeared either through closure or mergers. The reality is that the landscape changes year on year, and so the number and inclusion of providers does vary.

The overall market share picture is remarkably similar to last year, with the only percentage shifts being a 1 per cent increase to 52 per cent for Moodle. This is due to an increasing proportion of smaller HE providers this year, which is where Moodle implementations are particularly dominant. The 1 per cent decrease in Other VLEs in use reflects both a change in the composition of providers included and a small market shift, with this year marking the end of any HE providers using Aula, other than its owner, Coventry University.

Proportion of VLEs being used by 272 UK HE providers researched as of the end of 2025.

This market share data should be considered as a high-level snapshot in time and should be coupled with an understanding of the slow-moving nature of this market. The shifts and dynamics of the market become more interesting as you drill down into the data.

Market share by UK HE provider size and type in 2025

Exploring market share by provider size provides a different level of insight into the selection of these products by UK HE providers. The following analysis of market share by provider size is based on the total number of UK-based students, including international on-campus students but excluding transnational education (TNE) students. This year, I’ve slightly tweaked the ranges that determine provider size as follows:

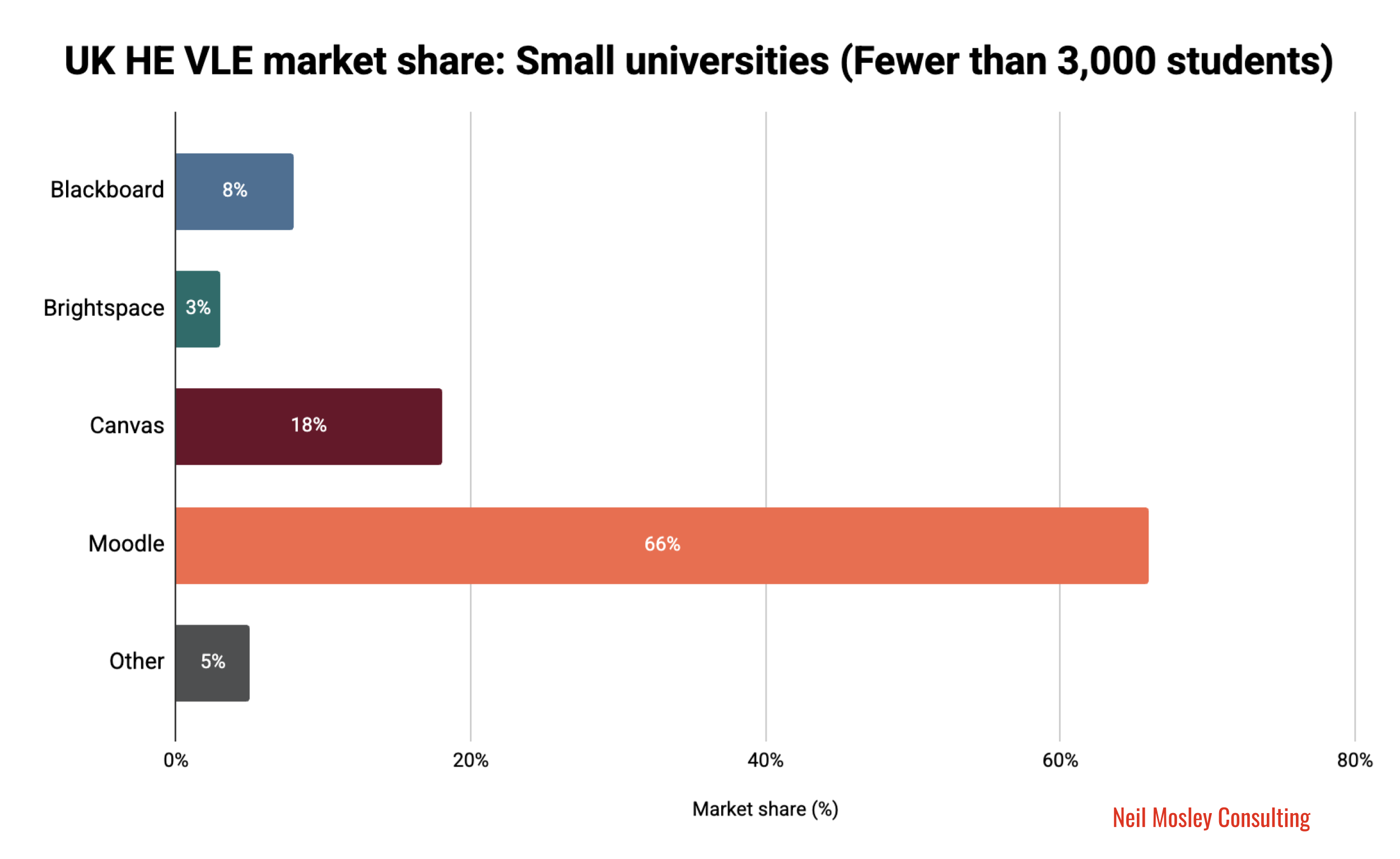

Small: fewer than 3,000 students

Medium: 3,000 to 15,000 students

Large: Over 15,000 students

Large university VLE market segment analysis

Blackboard and Moodle continue to be the most widely used VLEs among large UK HE providers, but this year has seen a continuation of inroads being made by Instructure and D2L. In this segment, Imperial College decided to replace its long-standing Blackboard VLE with Canvas, and the University of the West of Scotland announced it would be replacing Aula with Brightspace from D2L.

Both Moodle and Blackboard implementations in this segment represent historic adoptions, in some cases dating back 20 years. However, over time Moodle has maintained a relatively stable share of this segment and a high degree of loyalty, with only 2% of the large institutions included in this group having replaced it as their main VLE. The same cannot be said of Blackboard, as 13% of this group have replaced it as their main VLE at some point in their recent history.

Medium university VLE market segment analysis

As the size of institutions decreases, Moodle’s share increases, however, a familiar pattern prevails in this segment. Institutions that historically adopted either Moodle or Blackboard are choosing to replace them with Canvas or Brightspace, with Moodle showing greater losses in this segment than among large providers.

Small university VLE market segment analysis

Moodle remains hugely dominant in the long tail of small providers operating in UK higher education. Although some small institutions have moved away from Moodle, the number is small and, in general, this segment, while larger in terms of the number of institutions, has tended to see far fewer VLE changes from one provider to another.

Russell Group university VLE market segment analysis

An additional area of analysis this year looks at perhaps the most easily demarcated group of universities, the Russell Group, made up of 24 large, prestigious institutions. I think it is here that we can most clearly see the success Instructure has had since beginning to operate in the UK in the mid 2010s. As of this year’s analysis, Canvas is used by nearly a third of Russell Group universities, and Instructure has secured a number of high-profile switches within this group in recent years, including Imperial College and the University of Manchester. While Russell Group universities using Moodle have largely remained loyal over this period, Blackboard has been replaced by a number of Russell Group institutions over the last 10 years.

Key company and product developments in the UK VLE market

There have been a number of significant developments within the companies behind these VLE products, as well as in the products themselves. While not a comprehensive analysis, below are some of the key changes within the companies and their associated VLE platforms.

Blackboard and Anthology in 2025

It has been quite a 12 months for Anthology, the company behind the Blackboard VLE. In May, reports emerged about issues arising from the level of debt the company was carrying, including negotiations with lenders and the possibility of a sale. Then, at the end of September, it was announced that Anthology had filed for Chapter 11 bankruptcy, a restructuring process that online education company 2U also went through. The net result is that Anthology is about to emerge from this process as a debt-free company with a more concentrated focus on teaching and learning products, including the Blackboard VLE. In the process, it has sold its former Enterprise Operations business to Ellucian, and its Lifecycle Engagement business to Encoura.

Although this move was not entirely unexpected by market analysts, it is probably the biggest piece of news in the VLE market over the past year. While the process itself appears to have gone well, there are several central questions that continue to hang over the company. These include who will lead the organisation and, more importantly, what its strategy will look like in the coming years. Equally, while there has not been any kind of mass exodus, there are questions about the impact this will have on customer perceptions and decision-making as and when institutions review their virtual learning environment.

Recent years have seen positive developments from Anthology. These include moving clients onto Ultra and finally moving to retire Learn, thus addressing the long-standing incoherence of effectively maintaining two VLE products. They also include increased investment in product development, with Anthology claiming in 2025 that it had released more features than any of its competitors for three consecutive years. The company has also been the most aggressive in integrating AI features into Blackboard.

The past year also saw the release of another AI product feature, the Anthology Virtual Assistant, or AVA. The functionality within this feature is primarily focused on supporting academics, with capabilities such as automated nudges and messages to students, AI-generated draft responses to common student questions, and AI-powered tools for generating student feedback. One of the more notable elements of AVA is the AVA Playground, an area where students can access and experiment with a range of generative AI models within Blackboard, with all activity logged and visible to academics. AVA continues the recent rhythm of Anthology releasing substantive AI features and supports their market positioning of releasing the most features and being the most proactive around AI.

However, the Chapter 11 bankruptcy has abruptly punctuated this sense of progress and forward momentum in product development. The post-2021 phase has now come to a close, and the company is entering a new one. In one sense, at least in the UK, it could be argued that for all that has happened over the past five years, Anthology’s position in the UK HE market remains largely unchanged. This year’s analysis continues to show that while a number of UK HE providers still use Blackboard as their main VLE, its market share continues to decline gradually, with Imperial College this year adding to the recent examples of institutions switching away from the platform.

Anthology can rightly point to a base of loyal HE provider customers cultivated over many years, and it is certainly true that acquisition often receives greater attention than retention, despite the value of both being comparable. However, the more immediate and enduring issue is the uncertainty created by the restructuring process and the wider change it represents. Perceptions influence choice, and while the process undertaken is not bankruptcy in the purest sense, negative perceptions can form regardless of their fidelity to reality. For Anthology and Blackboard, much has changed in recent years, but the prevailing challenge remains persuading UK HE providers not only to stop switching to competitors, but also to proactively select Blackboard when they are looking to change.

Canvas and Instructure in 2025

As alluded to earlier, Instructure has had another year of success in winning new UK HE customers. In addition to Imperial College selecting Canvas as its new VLE, it has also been chosen by the University of London for its Global Digital Campus. These are notable wins in what is a slow-moving market, and they continue the annual rhythm of more UK HE providers switching to Canvas.

Alongside this, there have been a number of eye-catching announcements from Instructure over the last year. One that attracted the most attention was the announcement of a partnership with OpenAI, with the key outcome being a new activity feature within Canvas called the LLM assignment. This feature enables a custom-GPT-style conversational experience within the VLE and, at this early stage, does not appear drastically dissimilar to the AI Conversations feature launched by Blackboard in 2024.

Inevitably, a partnership with OpenAI is going to attract a lot of attention, and that sense of interest shares similarities with the announcement of a partnership between Instructure and Khan Academy in 2023 (remember that?). However, in terms of AI, the bigger announcement, in my opinion, was the launch of IgniteAI. The reason for this is that it was not an AI product feature announcement but rather an announcement that encapsulates Instructure’s broader approach to AI within the Canvas ecosystem.

IgniteAI is more of an architectural foundation than a user-facing feature, enabling the use of AI capabilities across the ecosystem. Instructure was quick to distinguish its approach from that of its competitors, contrasting it with what it described as isolated AI point solutions. There is, however, some potential for confusion here, particularly as product developments that predate IgniteAI, such as discussion summaries, are the types of features that will now be powered by this underlying approach and carry the IgniteAI spark branding.

Overall, this represents a differentiated approach to AI at the architectural level of a VLE product, although the early manifestations of IgniteAI-powered features do not yet fully convey that distinctiveness. The more significant change may come with the planned IgniteAI Agent, a conversational AI assistant intended to allow academics to use single prompts to execute more complex, multi-step tasks. Early IgniteAI-powered features, such as discussion summaries and rubric generation, feel more like point solutions, whereas the forthcoming agentic capability has the potential to be genuinely significant, particularly in comparison with competitors’ approaches to date.

A lot of the analysis of the main VLE providers in recent years has focused on AI product strategies, and 2025 is the year in which Instructure’s approach has become more visible. I cannot help but think that framing differentiation in terms of individual AI features versus a more holistic approach may not age particularly well as a long-term distinction, but we are still at an early stage. Instructure will be hoping that the articulation of its AI approach, along with subsequent feature releases, continues to support what has now been many years of success in attracting UK HE providers to switch to Canvas.

Moodle in 2025

Moodle is always harder to analyse in market-share terms because it operates differently from the other main VLE market players. It does not typically compete directly for UK higher education VLE tenders. Instead, UK HE providers usually work through partners, such as CoSector, Catalyst IT and Titus Learning, for hosting, support and development.

This year’s data, as in previous years, reinforces how widely Moodle is used as a main VLE in UK higher education. However, this tends to reflect widespread adoption among micro and small providers and historic adoption and loyalty, rather than sustained new adoption. Although Moodle’s overall share of the market has not reduced as significantly or as rapidly as Blackboard’s, the story in the UK HE market over recent years has been one of institutions moving away from Moodle rather than proactively selecting it when a VLE change is sought.

Recent years have seen significant internal changes at Moodle, with founder Martin Dougiamas stepping down and Scott Anderberg being appointed as the new CEO in late 2023. Inevitably, it takes time to understand how these changes influence future strategy and approach, but this is now starting to take shape. In his reflections on a year in the role, Scott Anderberg highlighted the need for Moodle to change how it operates as a business and to capture more of the value it has created in the market back into Moodle.

One significant announcement this year at the annual MoodleMoot conference that resonated strongly with this message was the proposal of a tailored Moodle VLE for higher education as a premium product, rather than a free, fully open-source one. What this will look like and when it will be delivered remains to be seen, but it marks a significant shift in direction and positioning in relation to higher education.

When considering the Moodle VLE product itself, it is difficult to point to developments of the same nature or significance as those seen among the other main VLEs in the UK HE market. While there is a regular cadence of Moodle version updates, the extent to which these changes are large, significant or paradigm-altering is debatable. That said, reporting from MoodleMoot confirmed what Moodle described as investing in fundamentals, including a new design system and technical transformation. There is a clear commitment to making more fundamental changes and investments in the Moodle platform, but both here and in relation to new product lines, it is too early to see what the outcomes will be.

Nevertheless, the posture of Moodle is changing, particularly when viewed through the lens of UK HE market orientation. This will not be an easy transition, as Moodle is not simply a product or a company, it also represents a community and is valued as much for what it represents as for the product itself. That said, the need for change and greater investment in developing and modernising the platform has felt necessary for some time.

It would be remiss not to mention AI in relation to Moodle, where, broadly speaking, there has been little that is genuinely new. AI features and capabilities have not yet been baked directly into the platform; instead, Moodle has enabled the integration of external AI tools, framing AI as a locally controlled, optional extra. This feels like it fits the Moodle ethos and clearly differentiates it, which some will see as laudable. However, there is a risk that this approach becomes a negative point of differentiation over time and dates the platform. The implication from MoodleMoot reporting, although not stated explicitly, was that Moodle Higher Education would not adopt such an optional approach to AI and would instead take a different stance, although there is currently nothing concrete in terms of actual plans as far as I can tell.

Overall, this feels like the most interesting period for Moodle since I have been covering this market. While these are still early days and little has yet materialised in concrete terms, there are some genuinely interesting plans and much-needed change being set in motion, and I look forward to reflecting on where things stand next year.

Brightspace and D2L in 2025

This has been another year of D2L gaining more of a foothold in the UK market and, although the number of UK HE providers switching to Brightspace is not at the same level as Canvas, the company continues on an upward trajectory. Over the past year, it has gained another UK customer in the form of the University of the West of Scotland, which is moving from the ill-fated Aula. This marks the culmination of the slow demise of Aula as a player in this market, with the product now existing solely as a Coventry University-owned, in-house VLE.

2024 was a year of significant announcements from D2L, with the company acquiring the interactive content creation company H5P and launching its flagship AI feature, D2L Lumi. Understandably, 2025 has not matched the scale of those developments, but it is nevertheless not without note. Product developments this year feel more like building on what has come before, including the further development of D2L Lumi.

Although this differs from the approach taken by Instructure with IgniteAI, at the surface level of the platform there does not yet appear to be a substantial distinction between IgniteAI and D2L Lumi. The latter is appearing in more and more areas across Brightspace, with new AI capabilities added this year. While there may be architectural differences under the hood, what is similar is the creation of what is effectively an AI sub-brand or feature wrapper within the VLE.

This year, D2L announced new features for Lumi with the addition of Study Support, Insights, Tutor and Feedback. This brings the number of distinct elements wrapped into Lumi to thirteen. These developments expand the AI capabilities within Brightspace, but Lumi itself is not a paradigm-altering implementation of AI within the VLE. Rather, it currently represents a suite of AI-powered supporting features focused on improving content and activity creation and providing supplementary student support, both in relation to specific activities and more generally.

There have yet to be any new native AI learning activity types developed, akin to AI Conversations in Blackboard or the LLM Assignment feature in Canvas. Instead, D2L appears to have focused its AI product development on augmenting existing Brightspace activities and workflows. This is evident with the addition of Study Support, which is not as holistic as the name might suggest, but instead provides suggested relevant content or a brief two to three sentence overview for learners based on their quiz results. One wonders what comes next for D2L Lumi in the year ahead. As a branded wrapper for AI functionality it makes sense, but as these capabilities increasingly permeate workflows and the platform more broadly, its existence as a distinct product rather than simply part of how the platform works may come into question, although this is also a challenge that will be faced by everyone else.

Beyond AI features, D2L announced CreateSpace this year, which feels akin to a Google Drive-style environment for content, assignments and courses within the VLE, supporting sharing, editing and reuse rather than simply storage. Alongside this, there has also been growing integration of H5P into the platform, particularly through Creator+.

Overall, this has felt like another solid year for D2L in the context of the UK HE market. Arguably, the company has been the most stable of the major VLE providers in recent years, and that stability counts for something in a slow-moving market, particularly one in which other players have experienced leadership changes, ownership changes and, in some cases, significant turbulence.

Reflections on the UK VLE market in 2025

Although the market data and analysis show little to no change in percentage market shares, this is, to a certain extent, veiled by the evolving landscape of HE providers, meaning that each year’s analysis is not rigidly fixed on the same institutions. Even if such an approach were taken, mergers and closures would still affect the fidelity of a pure time series analysis.

However, the story presented by this year’s analysis almost perfectly reinforces overarching market trends seen in recent years. These include Instructure’s Canvas being selected by a growing number of UK HE providers and increasingly becoming the choice for Russell Group universities looking to switch, as evidenced by Imperial College’s decision this past year. Similarly, D2L’s Brightspace continues to be frequently selected, with the company growing its number of UK HE customers again this year. As such, the past year has seen a continuation of the trend of Canvas and Brightspace being selected by UK HE providers, and their parent companies increasing their share of the market.

Conversely, despite what has felt like admirable efforts in recent years to reverse the loss of UK HE provider customers, institutions continue to switch away from the Blackboard VLE. Last year, I struck a more hopeful note on Anthology winning new UK HE customers, given the evident progress they had made, while also noting the financial cloud hanging over the company. In fairness, they should emerge unencumbered by that, but they will do so with some inevitable brand damage and a loss of strategic continuity, which will require renewed effort to re-articulate their strategy, approach and rebuild trust.

Perhaps the one outlier in terms of alignment with long-standing trends is Moodle. To be candid, analysing the company and product annually has at times felt like groundhog day, but things now appear to be genuinely beginning to change, and I am anticipating more interesting developments over the next year or so. Whether these prove to be genuinely market-influencing developments will need to be judged over a longer timescale, but it feels as though a prolonged period of stasis may be coming to an end, with a growing sense of anticipation about what lies ahead.

Before closing, it is worth briefly commenting on an aspect of AI hysteria that emerged this past year in relation to the VLE. I am referring to the rise of agentic AI and the ability for students to delegate actions such as logging in and completing activities. A key missing element in much of the discourse around AI in higher education lies in the gap between capability and behaviour. Unfortunately, I find some of the voices in this wider discourse seem to have had their cognitive abilities impaired by AI, but not through using it. If we continue to confuse what people could do with what they will do, and tackle behavioural challenges from a purely technological standpoint, we’ll get nowhere.

This may be the latest perceived threat facing the virtual learning environment, but despite the twists and turns of the past year, what I have found consistently, and this year is no different, is that almost all UK HE providers, with the exception of a small number of very small institutions, continue to use virtual learning environments. Equally, what has been evident this year and in recent years is product evolution rather than collapse. There are some genuinely interesting developments, both in terms of products and companies, and I am already looking forward to reflecting on where things stand this time next year.